Conquer the complexity of item classification with the power of artificial intelligence

Fast and simple taxability categorization across your product catalog through advanced product classification software

Schedule a call

Conquer the complexity of item classification with the power of artificial intelligence

Fast and simple taxability categorization across your product catalog through advanced product classification software

Schedule a call

Ease the burden of item classification

Product classification software streamlines mapping domestic and international tax codes

- Item Classification can be time-consuming and different for each jurisdiction.

- The U.S. alone has more than 12,000 sales and use tax jurisdictions.

- Classification becomes even more complex if you sell internationally.

Expedite and simplify your process with automated product classification software

Identify items for your industry

Categorize products in complex industries including retail, food and beverage, software, manufacturing, construction, and business services.

Classify quickly with technology

Receive up-to-date classification powered by algorithms driven by machine learning, human expertise, and an AI-based classification engine.

Charge tax with greater accuracy

Improve the customer experience by mitigating under- or overcharging tax due to incorrect classification.

Streamline and save time

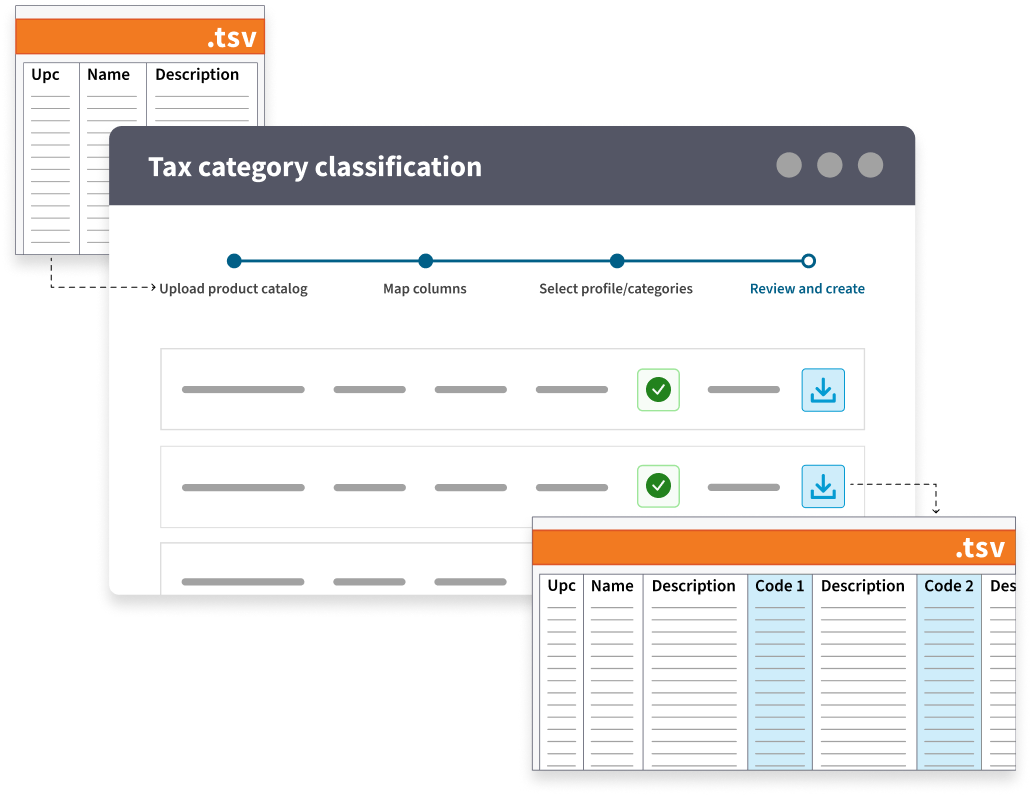

Bulk upload capabilities for product and service catalogs speed up your classification process.

Let AI agents do the work

Imagine a digital compliance team that works 24/7, never fatigues, and always stays current with the latest rules for all jurisdictions. That’s agentic compliance in action.

Product classification software for your industry and product catalog

Product classification software for your industry and product catalog

Avalara Tax Code Classification

Automate item classification with AI-powered image recognition

Now included in Avalara AvaTax, this feature lets you upload product images and receive instant Avalara tax code suggestions.

IDEAL FOR:

Businesses with visual catalogs or unclear product descriptions. Improves accuracy and reduces manual work in retail, ecommerce, manufacturing, and wholesale.

Leverage the full power of AvaTax

Use both product images and item details to classify products more accurately at no additional cost.

Reduce the need to find codes individually

AI analyzes product images and suggests tax codes instantly, even when text is unclear.

Save time and improve efficiency

Eliminate manual review or third-party classification services with built-in automation.

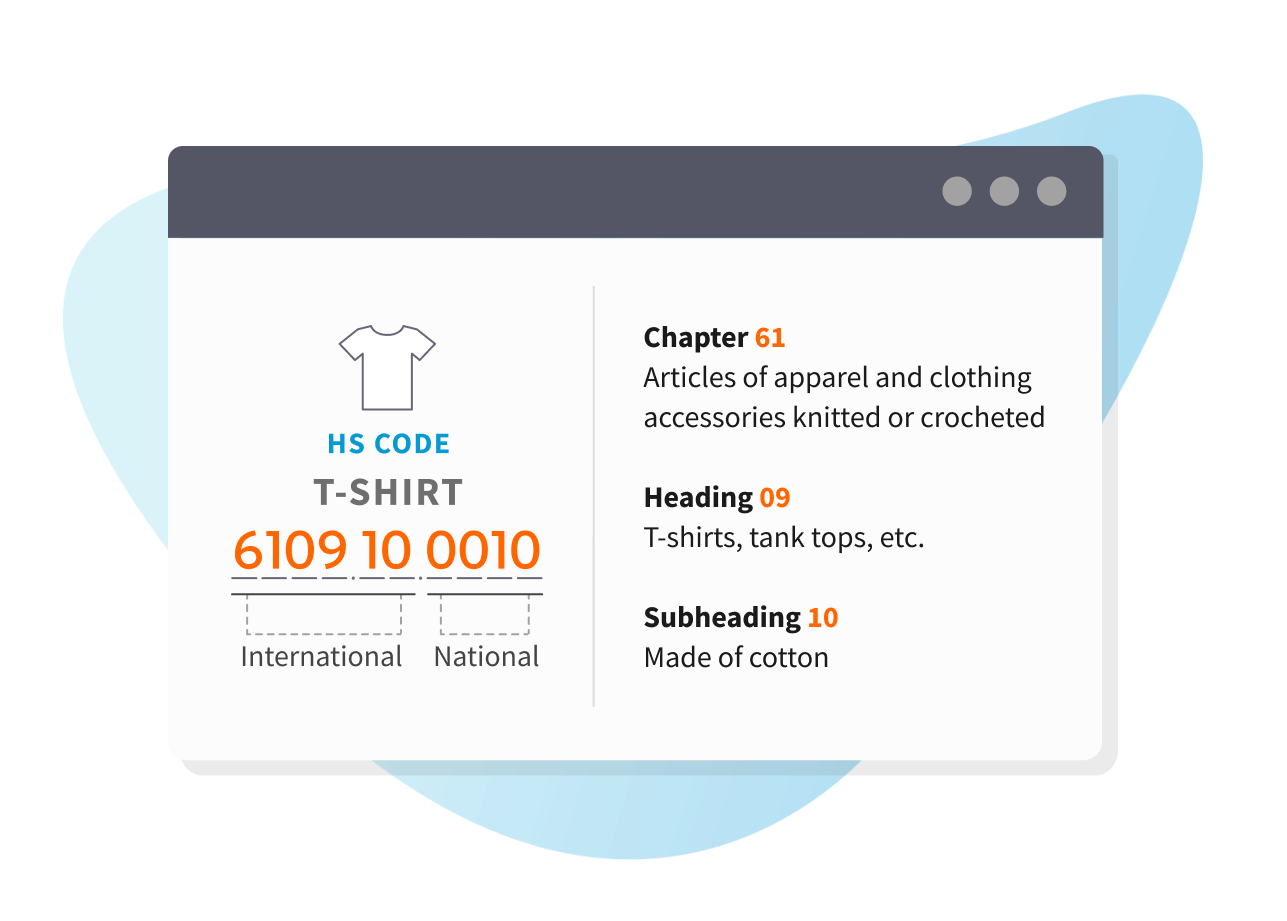

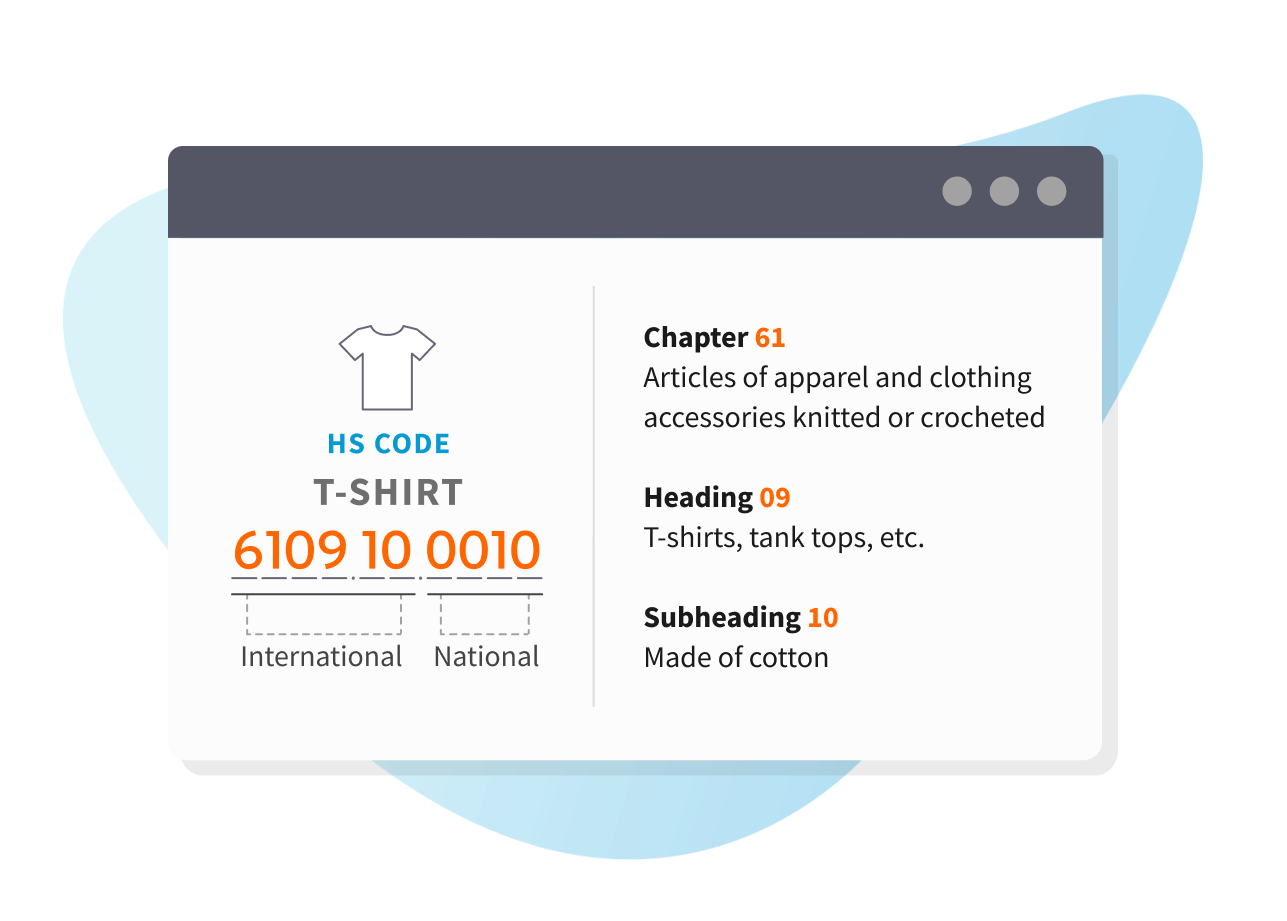

Avalara Tariff Code Classification

Instantly assign Harmonized System (HS) codes with confidence

IDEAL FOR: Ecommerce sellers, marketplaces, third-party logistics providers, and companies doing business across borders

Avalara Self-Serve Tariff Code Classification is an intuitive AI-enabled tool that allows you to easily determine codes and requires no prior experience in HS classification.

Avalara Managed Tariff Code Classification combines AI and human expertise to quickly assign consistent tariff codes for consumer products shipped to 180+ countries.

Avalara Managed Tariff Code Classification Premium also uses AI and human expertise to determine codes while providing additional background and rationale to support customs audits.

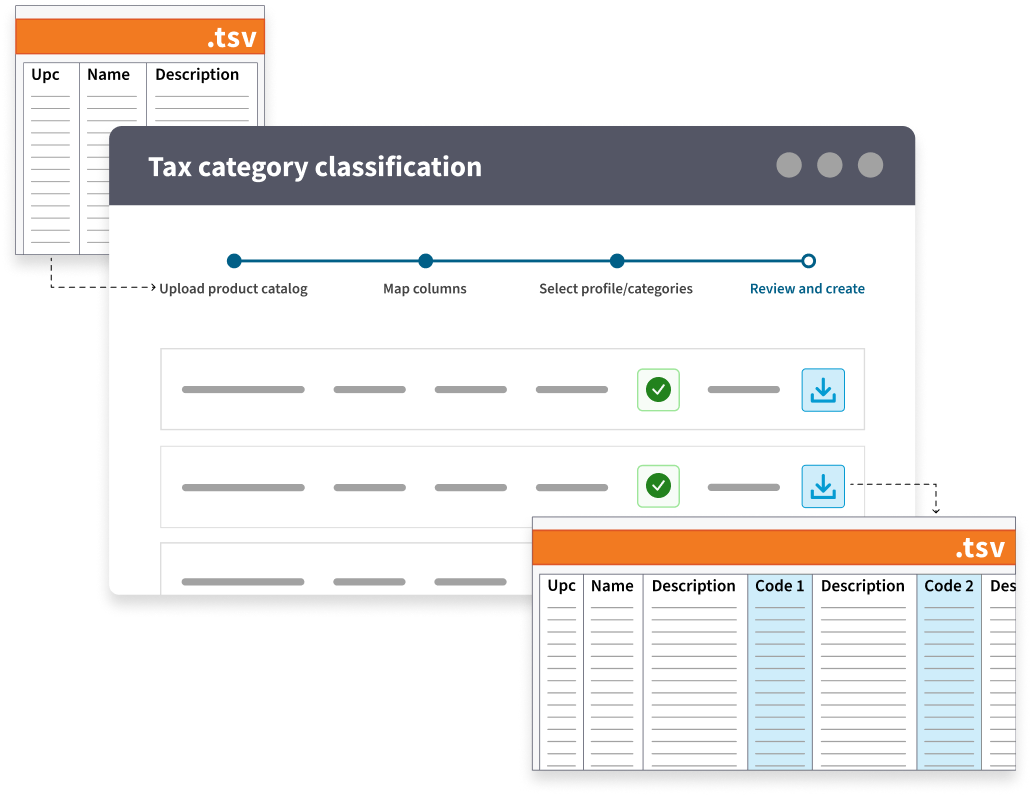

Avalara Managed Tax Category Classification

Capitalize on artificial intelligence (AI) and assisted classification services with cloud-based software

IDEAL FOR: Businesses with complex products and services that also frequently add new items to their catalogs

Quickly and easily determine tax categories with an AI-based classification engine.

Check classification decisions with experts to help ensure greater accuracy.

Use as a standalone product or incorporate into your tax compliance solution.

Identify the right Item Classification product for you

Avalara Tax Code Classification

Avalara Managed Tariff Code Classification

Avalara Managed Tax Category Classification

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

For current AvaTax users with stable product catalogs

For ecommerce sellers and companies doing business across borders

For companies with complex products and frequently changing catalogs

Lookup based on universal identifiers (e.g. UPC, GTIN, EAN, etc.)

-

Avalara tax code classification

-

Tax category classification

-

API upload

-

Multiple input formats (API, FTP, direct uploads to UI, etc.)

-

Configurable output formats (.csv, Oracle, .xml, webhooks, etc.)

-

Reporting and analytics

-

Up to 1 million items per month

-

Job management within the tool

-

-

Special compliance considerations for SNAP, WIC, etc.

-

-

Professional services assistance and mapping

-

-

Country-specific HS code classification

-

-

Explore international tax solutions

Automated HS code classification and international tax solutions built for your business across products and industries

Explore international tax solutions

Automated HS code classification and international tax solutions built for your business across products and industries

Frequently asked questions

Avalara tax codes are our way of identifying your products to help better determine more accurate tax rates.

The Harmonized System, or HS, is formally known as the Harmonized Commodity Description and Coding System. It’s the international standard for classifying traded products. It started in 1988 and is maintained by the World Customs Organization (WCO).

An HS code, or Harmonized System code, is a six-digit standard for classifying globally traded products. These are also used by customs authorities to identify duties for certain products.

Industries with complex products and large catalogs are ideal for product classification services. These industries include retail (including ecommerce), food and beverage, software, business services, manufacturing, and construction, to name a few.

Examples of businesses include grocery, convenience, hardware, and drug stores. This is in addition to software companies, manufacturers, medical suppliers, and commercial services providers.

To start, how an item is manufactured, where it’s sold, and how it's delivered all can impact its taxability. Furthermore, an item’s taxability can differ depending on the jurisdiction.

We offer three tariff code classification products to meet the needs of various businesses.

Our self-serve tool is designed for sellers with limited products or occasional international sales who are looking for an intuitive tool for HS code assignment.

Avalara Managed Tariff Code Classification is for businesses with a broader product catalog or ongoing international business transactions that need to automate more of the process.

Avalara Managed Tariff Code Classification Premium is made for importers, customs brokers, and companies that have more complex compliance concerns.

Trusted by

“I’d have to hire at least three people with tax experience to do the work that Avalara is doing for us.”

—Jay Macatangay, Chief Financial Officer

Identify your Item Classification solution

Quickly and efficiently identify your products and tax codes.

Identify your Item Classification solution

Quickly and efficiently identify your products and tax codes.