All you need to know about sales tax nexus

Nexus is a connection with a state requiring you to pay sales tax that’s triggered when you meet a tax threshold. Find out where you may need to register, collect, and file sales tax.

Video: Find out about sales activities that trigger tax compliance obligations in other states.

Avalara can help you track where you owe, register, and file.

3 reasons why you may need to collect sales tax in other states

Identify where and what triggers tax obligations

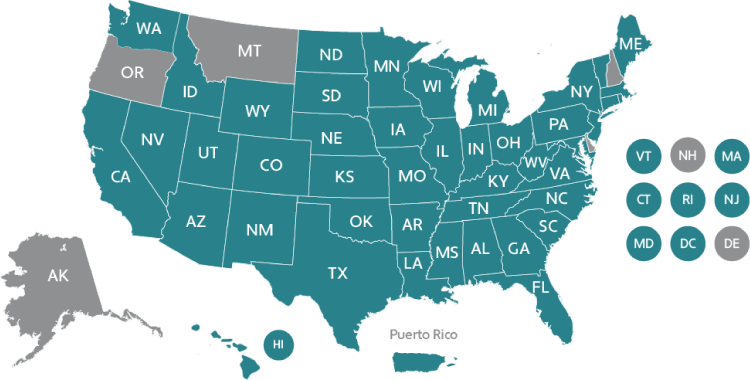

Economic nexus

- Economic nexus is triggered by reaching a certain amount of sales (e.g., $100,000) and/or a number of sales transactions (e.g., 200 transactions) in another state.

- Exempt sales of goods and services may count toward your economic nexus threshold in some states.

- You need to register in states where you have economic nexus.

Taxable transactions only

Taxable transactions and exempt sales

Exempt sales can count toward your nexus threshold, so you may need to register and report these sales.

Some states only count exempt sales of tangible personal property, others include exempt services.

Physical presence nexus

- All states with sales tax have physical nexus laws.

- Physical presence is established by more than just offices.

- Inventory in a marketplace warehouse can establish a physical tie.

- Remote employees may create physical presence nexus.

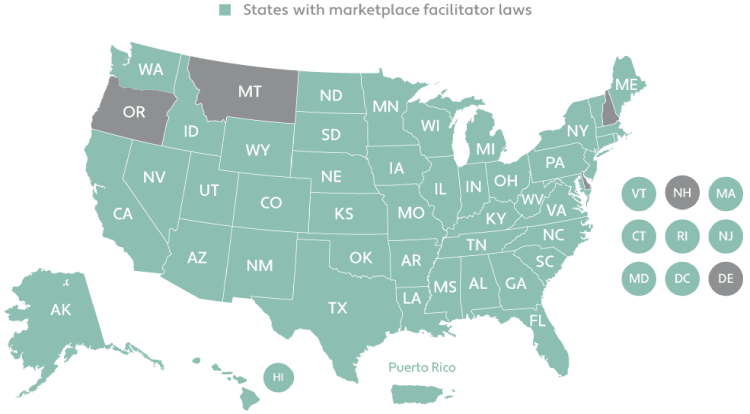

Marketplace facilitator laws

- Marketplace facilitator laws require marketplaces to collect sales tax on your behalf.

- Over 45 states, plus Washington, D.C., parts of Alaska, and Puerto Rico have marketplace facilitator laws.

- You may need to register for sales tax even if you only sell on marketplaces.

- Laws and how they’re applied vary by state.

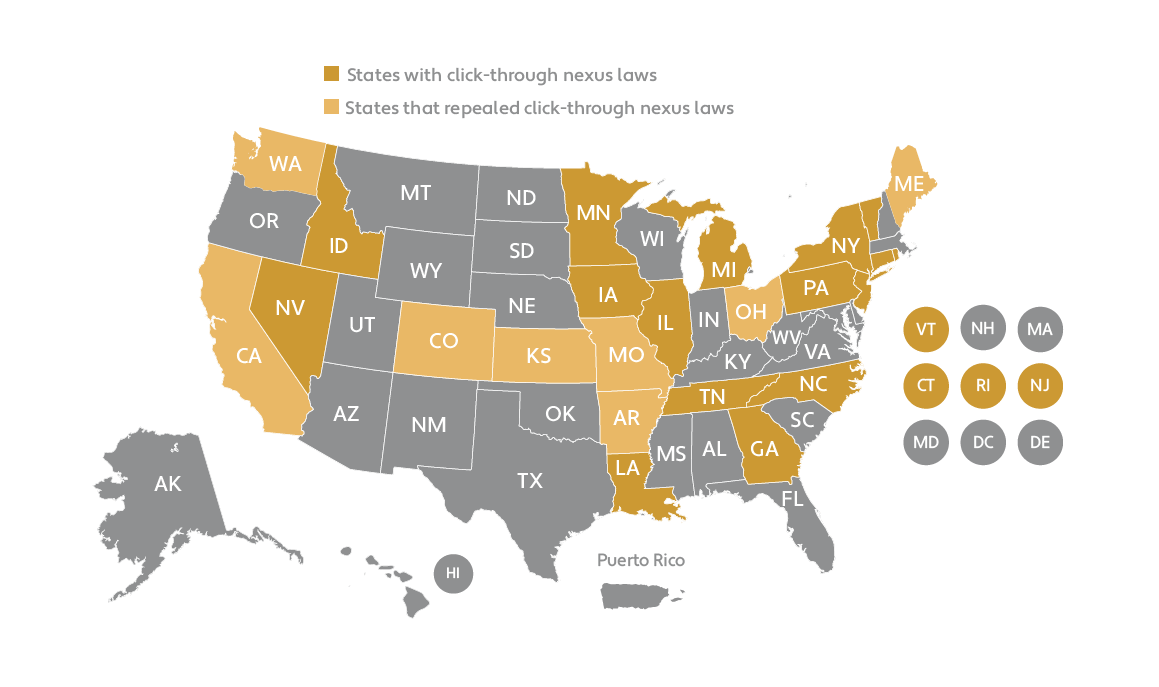

Click-through nexus

- Click-through nexus is triggered by out-of-state businesses rewarding in-state partners for referring customers through website links.

- It may apply to direct or indirect referrals.

- Close to 20 states have click-through nexus laws.

- Some states have repealed click-through nexus laws in favor of economic nexus.

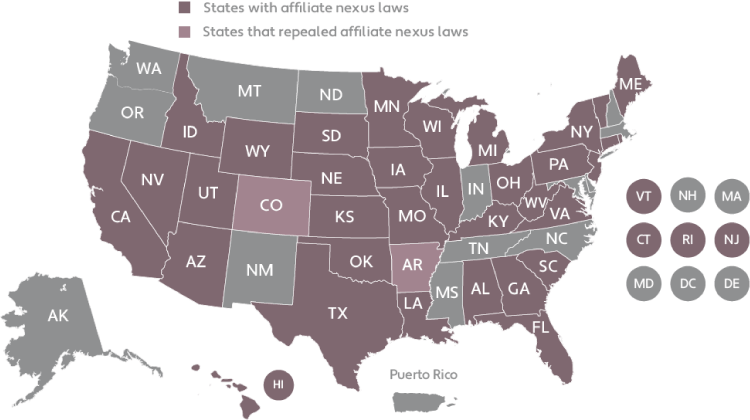

Affiliate nexus

- Affiliate nexus arises from a relationship between an out-of-state and in-state entity.

- Over 30 states have affiliate nexus laws.

- Entities may include employees, representatives, or other affiliates.

- Which relationships create affiliate nexus vary by state.

Know more about sales tax and nexus

If you trigger nexus in a state, you need to register to collect and remit sales tax there. Learn more about nexus laws in states where you sell and how they might impact you.

Many ecommerce, accounting, and ERP systems perform some sales tax processes, but they’re limited in ways to track sales in other states. Without the right tools and integrations, your ERP may not keep you informed of potential changes in nexus or sales tax obligations.

There is no statewide sales tax in the following states:

- Alaska*

- Delaware

- Montana

- New Hampshire

- Oregon

*Alaska has no statewide sales tax, but it does have home rule and allows cities and boroughs to pass their own local sales tax and economic nexus laws.

What’s a home rule state? Home rule in the following states allows municipalities or counties to pass their own laws as long as they don’t conflict with state laws:

- Alabama

- Alaska

- Arizona

- Colorado

- Idaho

- Illinois

- Louisiana

Towns and counties in some home rule states can set their own sales tax rates. You may be required to register with one or more local tax departments.

Some states are more complicated than others when it comes to filing sales and use tax returns. These are often states with the highest populations plus the highest sales tax revenue. They include the following states:

- California

- Florida

- New York

- Texas

- Illinois

Discover key tax changes and trends shaping compliance in our 10th annual report.

Discover key tax changes and trends shaping compliance in our 10th annual report.

Your next stages for automating compliance

Discover where you need to register for sales tax

Almost every state requires businesses to register to collect and file sales tax if their sales volume is high enough. Find out where you might be obligated.

Consider registering in the states where you’ve hit thresholds

Ready to collect and remit sales tax in new states? Avalara Sales Tax Registration can get you registered for $349 per location.

Automate your sales tax rate calculations

Avalara AvaTax collects sales and use tax using more accurate tax rates, helps track nexus, and integrates with your existing business systems.

Stay on top of sales tax obligations

Avoid sales tax surprises and maintain compliance in all the states where you sell

Stay on top of sales tax obligations

Avoid sales tax surprises and maintain compliance in all the states where you sell