Do exempt sales count toward state economic nexus thresholds?

For more recent information, read Why you can have sales tax obligations even if you only make exempt sales.

More than two years after the Supreme Court of the United States issued its pivotal ruling in South Dakota v. Wayfair, Inc., businesses are still coming to terms with their new sales and use tax obligations. The decision granted states the authority to tax remote sales, rocking the world of retail. Yet it doesn’t just impact retailers of taxable goods: Many businesses dealing primarily in exempt transactions also have new registration and filing requirements as a result of the Wayfair ruling and subsequent state economic nexus laws.

Recap: South Dakota v. Wayfair, Inc. and the birth of economic nexus

State taxing authority hinges on nexus, which is a connection or link. Prior to Wayfair, physical presence nexus was the requisite for sales tax; states could not require a business to register then collect and remit sales tax unless the businesses had some sort of physical tie to the state, such as employees, inventory, or a brick-and-mortar store.

The Wayfair ruling deemed the physical presence rule to be “unsound and incorrect,” thus allowing South Dakota — and by extension other states — to tax sales by businesses with no physical presence in the state. Nexus can now be based solely on an out-of-state seller’s economic activity in a state (economic nexus).

Having a physical presence in a state still establishes nexus. Yet since June 21, 2018, states also have the authority to enforce economic nexus.

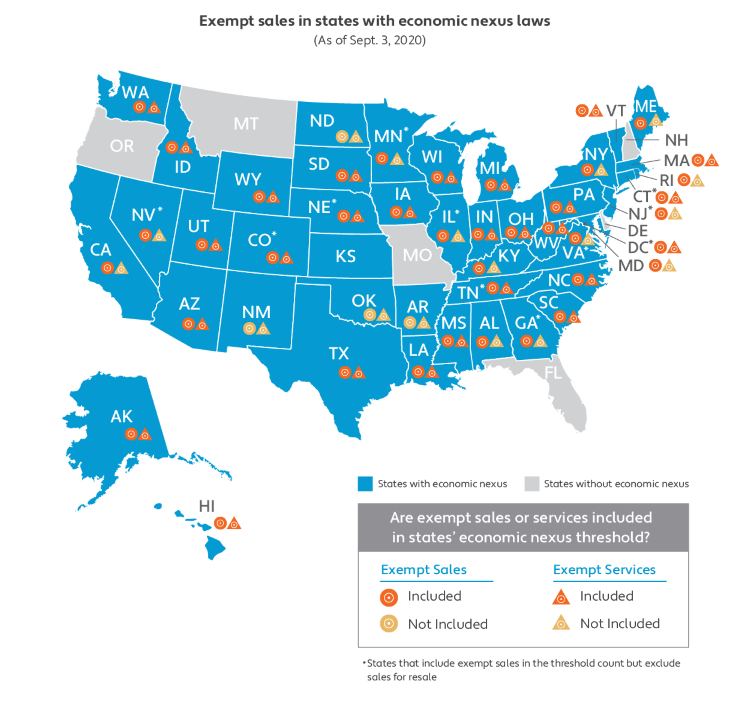

As of this writing, 43 states and the District of Columbia have an economic nexus law or rule. Some of these impact businesses dealing primarily or even exclusively in exempt transactions.

Economic nexus thresholds

Almost all states with economic nexus allow an exception for small remote sellers, which is determined by a remote seller’s sales and/or transactions in the state (the economic nexus threshold).

Any remote seller whose sales into the state meet or exceed a state’s economic nexus threshold must register with that state’s tax authority, collect and remit sales tax, validate exempt transactions, and file sales tax returns as required by law. Remote sellers whose sales and/or transactions in a state are under the state’s threshold don’t need to register; however, they do need to monitor their sales into the state, so they know if they develop economic nexus.

Unfortunately, state economic nexus thresholds vary widely. This seriously complicates nexus determinations. For example:

- South Dakota’s threshold is more than $100,000 in sales or at least 200 transactions in the state in the current or previous calendar year. Taxable and exempt sales of tangible personal property (TPP), electronically delivered products, or services are included in the threshold count.

- California’s threshold is more than $500,000 in sales in the preceding or current calendar year (there’s no transaction threshold); retail sales of TPP delivered into the state by the retailer and affiliates are included in the threshold count, including exempt sales of TPP and TPP sales for resale. However, neither taxable nor exempt services count toward the threshold.

Because many states include exempt transactions in their economic nexus thresholds, businesses that only make exempt sales into other states can establish economic nexus.

States that include exempt sales in the economic nexus threshold

Some state economic nexus thresholds are based on retail sales; in these states, exempt sales are generally excluded from the threshold count. States basing the threshold on gross sales typically include exempt sales in the threshold, though some may exclude sales for resale. Yet generalizations should be avoided because each state’s economic nexus threshold is unique.

In North Dakota, for example, the threshold is based on gross taxable sales of TPP and other items into the state. The threshold includes taxable services (though there aren’t many taxable services in North Dakota), but excludes exempt TPP and exempt services. New York’s threshold includes exempt TPP (including software as a service, or SaaS), but not taxable or exempt services.

The table below lists how state economic nexus laws treat exempt sales of TPP and exempt services. If there's a check mark, the exempt transaction should be counted when determining if economic nexus has been established. Note: This information is subject to change, so please confirm with the state before acting on it.

| STATE | EXEMPT TPP | EXEMPT SERVICES | NOTES | |

| ALABAMA | ✓ | Wholesales of TPP are not included | ||

| ALASKA | ✓ | ✓ | ||

| ARIZONA | ✓ | ✓ | ||

| ARKANSAS | ||||

| CALIFORNIA | ✓ | Resales of TPP are included | ||

| COLORADO | ✓ | ✓ | Wholesales of TPP and services are excluded | |

| CONNECTICUT | ✓ | ✓ | As of July 1, 2019, exempt TPP and exempt services are included in the sales threshold but not the transaction threshold | |

| GEORGIA | ✓ | Resales of TPP are not included | ||

| HAWAII | ✓ | ✓ | ||

| IDAHO | ✓ | ✓ | ||

| ILLINOIS | ✓ | Resales and occasional sales are not included; exempt TPP transferred incident to a service is included: more details here | ||

| INDIANA | ✓ | ✓ | ||

| IOWA | ✓ | ✓ | ||

| KANSAS | N/A | N/A | There is no threshold | |

| KENTUCKY | ✓ | |||

| LOUISIANA | ✓ | ✓ | ||

| MAINE | ✓ | |||

| MARYLAND | ✓ | |||

| MASSACHUSETTS | ✓ | ✓ | ||

| MICHIGAN | ✓ | ✓ | ||

| MINNESOTA | ✓ | Resales of TPP are not included | ||

| MISSISSIPPI | ✓ | ✓ | ||

| NEBRASKA | ✓ | ✓ | Resales of TPP and services are not included | |

| NEVADA | ✓ | Resales of TPP are not included | ||

| NEW JERSEY | ✓ | Resales of TPP are not included | ||

| NEW MEXICO | ||||

| NEW YORK | ✓ | |||

| NORTH CAROLINA | ✓ | ✓ | ||

| NORTH DAKOTA | ||||

| OHIO | ✓ | ✓ | ||

| OKLAHOMA | ||||

| PENNSYLVANIA | ✓ | ✓ | ||

| RHODE ISLAND | ✓ | |||

| SOUTH CAROLINA | ✓ | ✓ | ||

| SOUTH DAKOTA | ✓ | ✓ | ||

| TENNESSEE | ✓ | ✓ | Resales of TPP and services are not included | |

| TEXAS | ✓ | ✓ | ||

| UTAH | ✓ | ✓ | ||

| VERMONT | ✓ | ✓ | Remote businesses that make tax-exempt sales only are not required to register | |

| VIRGINIA | ✓ | Resales of TPP are not included | ||

| WASHINGTON | ✓ | ✓ | ||

| WASHINGTON, D.C. | ✓ | ✓ | Resales of TPP and services are not included | |

| WEST VIRGINIA | ✓ | ✓ | ||

| WISCONSIN | ✓ | ✓ | Remote wholesalers that make tax-exempt sales only are not required to register | |

| WYOMING | ✓ | ✓ |

Economic nexus and exemption certificate management

It’s critical to properly document exempt sales when you have economic nexus with a state. In the event you’re audited, you could be asked to provide a valid exemption or resale certificate for years’ worth of exempt transactions. That means you need a system to collect, store, and update exemption certificates in every state where you have nexus.

States have different types of exemption certificates, as well as different rules governing exemption certificate management — how often certificates need to be renewed and how long they need to be kept. You’ll need to familiarize yourself with those rules as your business establishes nexus in more states, and ensure you comply with them. States can and will hold you liable for the sales tax you didn’t collect if you can’t validate the exempt transaction with the proper certificate.

Expired, inaccurate, incomplete, or missing exemption certificates can leave your business liable for the uncollected sales tax, plus penalties and interest charges. And according to a Wakefield Research survey, 55% of respondents were found to have missing or inaccurate documents, including exemption certificates, during an audit.

Next steps

The first thing you need to do is determine where you have nexus. There are several ways to get started:

- Check out our seller’s guide to nexus laws and sales tax collection requirements for an overview of the different state sales tax nexus laws, as well as links to state-by-state guides to economic nexus laws and more.

- Take a free sales tax risk assessment to figure out where you may have economic nexus.

- Contact Avalara Professional Services to get assistance determining your sales tax registration requirements.

In states where you have nexus, automating exemption certificate management greatly reduces errors and the time spent dealing with sales tax documents. It enables you to securely collect and validate new sales tax exemption certificates during checkout.

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.