VAT vs Sales tax: A practical business guide for Indian sellers

The dynamic nature of VAT and sales tax due to constantly evolving market and geopolitical conditions add to the complexity and the need to stay updated as an exporter in 2022. As your business scales up and with the opening up of multiple channels for selling, understanding tax obligations and staying compliant gets more challenging. It becomes a manually intensive exercise for you and your employees and can become a costly affair if not handled carefully. Consumption taxes like VAT and sales tax cover a significant source of revenue for governments across the globe. (about 32.3% of tax revenues in OECD countries for the year 2019).

VAT and sales Tax are similar in the concept of indirect taxes. In India VAT was implemented in the year 2005 and came into effect for all the states of India and Union Territories(except Andaman and Nicobar Islands and Lakshadweep).VAT is a consumption tax levied on the value-added at each stage of the supply chain

US is the only major country in the world that utilizes sales and use tax instead of VAT. This guide is for businesses to understand the basic differences between sales tax, sales and use tax, and VAT and make a note of the methodology adopted when calculating each consumption tax.

Meaning: Sales Tax Vs VAT

Sales Tax

Sales tax is levied on the total commodity sales and borne by the end consumer only. This tax is applicable at the time of purchase of any type of goods. The state and central government can decide the sales tax percentage for each commodity.

Most of us are familiar with paying sales tax on the items we buy, such as a toothbrush or the latest model of our favorite smartphone. Sales tax is important as it plays a key role in state and local budget items such as schools, roads, and public transport services.

VAT

VAT also called value-added tax is distributed at various levels starting from the supply chain to the end consumer. The taxpayer reimburses the tax burden of the previous taxpayer. This means that businesses can reduce the input tax from their output tax. This is termed Input Tax Credit.

Incorporating this concept in the example of a steering manufacturer where the end revenue to the government remains the same as a sales tax but it is collected at all levels up to the consumer for VAT. The steering manufacturer sells his goods with a tax amount and the car manufacturer sells them to the dealer with input value taken. Later, he sells the same to the dealer at a price that includes the input value. Finally, the dealer sells the car to the consumer again with an input value taken.

Let’s look at the formula for VAT:

VAT = Output-Input tax

Example 1:

Original cost of steering = ₹100

Cost of steering for car manufacturer = ₹110

Here the value of ₹10 becomes input tax.

Suppose the car manufacturer fixes the price as ₹20000 + ₹2000

Here, ₹2000 is the tax paid to the dealer, and he gets Rs.10 reimbursed as input and remits the balance as VAT to the government i.e. he pays ₹1990/-.

Price fixed by the dealer after buying from car manufacturer = ₹30000+ ₹3000, where 1990/-. is reimbursed, and he pays the remaining ₹1010 to the government. Ultimately, the consumer who is charged 33000 gets reimbursed by all taxpayers.

Other features of VAT

VAT alleviate the cascading effect and other related economic distortions.

VAT introduces fairness and uniformity in the process of taxation.

VAT ensures better tax compliance and prevents the rise of tax evasion cases.

VAT ensures clear transparency in the sales of goods and services.

Types of Sales Tax and VAT

Sales taxes are of 5 different types wholesale sales tax, retail sales tax, manufacturers sales tax, value add tax, and use tax.

VAT is classified based on the consumption, income, and GNP of the product or services. It can be categorized based on product or service supplies like standard, zero, and exempted supplies.

How does VAT work?

Unlike sales tax which is levied at the end, VAT is paid at every transaction of the supply chain process from the exchange of raw materials to the point it reaches the final consumer.

Although the tax is paid at every stage of the good’s production, each subsequent taxpayer reimburses the input tax paid. This system creates a “self-accountable mechanism” where each business person’s activity can be accurately documented and encourages the taxpayers involved to follow the law.

For example:

How does US Sales Tax work?

Now that we know the difference between sales tax and VAT, the below explanation adds clarity to the differentiation between the two methods.

Citing an example for sales tax, suppose a shirt is sold to the end-user for USD 100, this is an all-inclusive cost.

The cost of producing a shirt (includes raw materials, the transportation cost, tailor’s salary, profit margin, and then the tax).

Suppose the sales tax is 7%

Cost of the shirt + Profit of USD 93.46 with a tax of USD 6.54. This USD 6.54 is what is paid to the government but only when the shirt is sold.

In VAT, however, the tax is paid at every instance of the supply chain. To elaborate, when the bales of cotton are bought by Mr. Anand from his supplier, he pays the cost price + profit margin of the supplier + VAT. The supplier in turn pays the tax to the government.VAT is paid on value-added at each stage of the supply chain. This way government doesn't need to wait until the product is finally sold.

The common point in both these types of tax is that the seller is solely responsible for collecting the tax and remitting it to the appropriate authority. It is also pertinent to note that in both instances the cost of the tax is ultimately borne by the end-user. In jurisdictions applying sales tax, the purchaser issues a tax exemption certificate to the supplier and hence does not pay taxes on the items purchased. In VAT-mandated jurisdiction, each party of the supply chain pays tax to their vendors and reclaims the VAT for the tax amount paid from their sales.

Click here to learn more about the tax requirements for selling products in the United States of America.

What do you mean by Use Tax and why does it exist in the US?

Use tax was brought in to help protect the in-state sellers. Under these laws, customers and buyers have to submit taxes for the purchase of products made outside of the state.

Applicability of Sales tax and VAT with slabs

Sales tax applicability is based on the services and goods sold by the seller.

The formula for sales tax calculation is Total Sales Tax = Cost of item x Sales tax rate.

France was the first country to incorporate GST to reduce tax evasion. This has led to more than 140 countries have implemented GST, with a few of them having a dual GST model (eg: Brazil and Canada)

In India the normal GST slabs are classified as 5%,12%, 18%, and 28%. The GST slab for Canada is charged at 5% whereas the Harmonized sales tax ranges from 0% to 15%.

VAT rate varies for different countries. The general VAT rate in India is 18%.

- This percentage again varies for different products and services:

- Luxembourg is the country with the lowest common-law VAT rate of 17%.

- Hungary is the country with the highest common-law VAT rate of 27%.

- The average VAT rate of the EU is 21% but the standard VAT rate of the UK is 20%.

The formula used for VAT is to Divide gross sale price by 1 + VAT rate.

What triggers the tax administration requirement in US and EU?

Sales and use tax obligations are based on:

Nexus - This refers to taxpayers with a physical presence in a tax jurisdiction or who meet the criteria of economic nexus thresholds.

VAT collection is based on the following conditions:

Permanent establishment – Existence of a facility, bookkeeping facilities, or ability to enter contracts.(The definition of the permanent establishment may differ based on the country)

Registration threshold – Taxpayers with business activities that exceed the monetary threshold in a tax jurisdiction

Sometimes a specific activity triggers a VAT registration obligation (e.g. legal services).

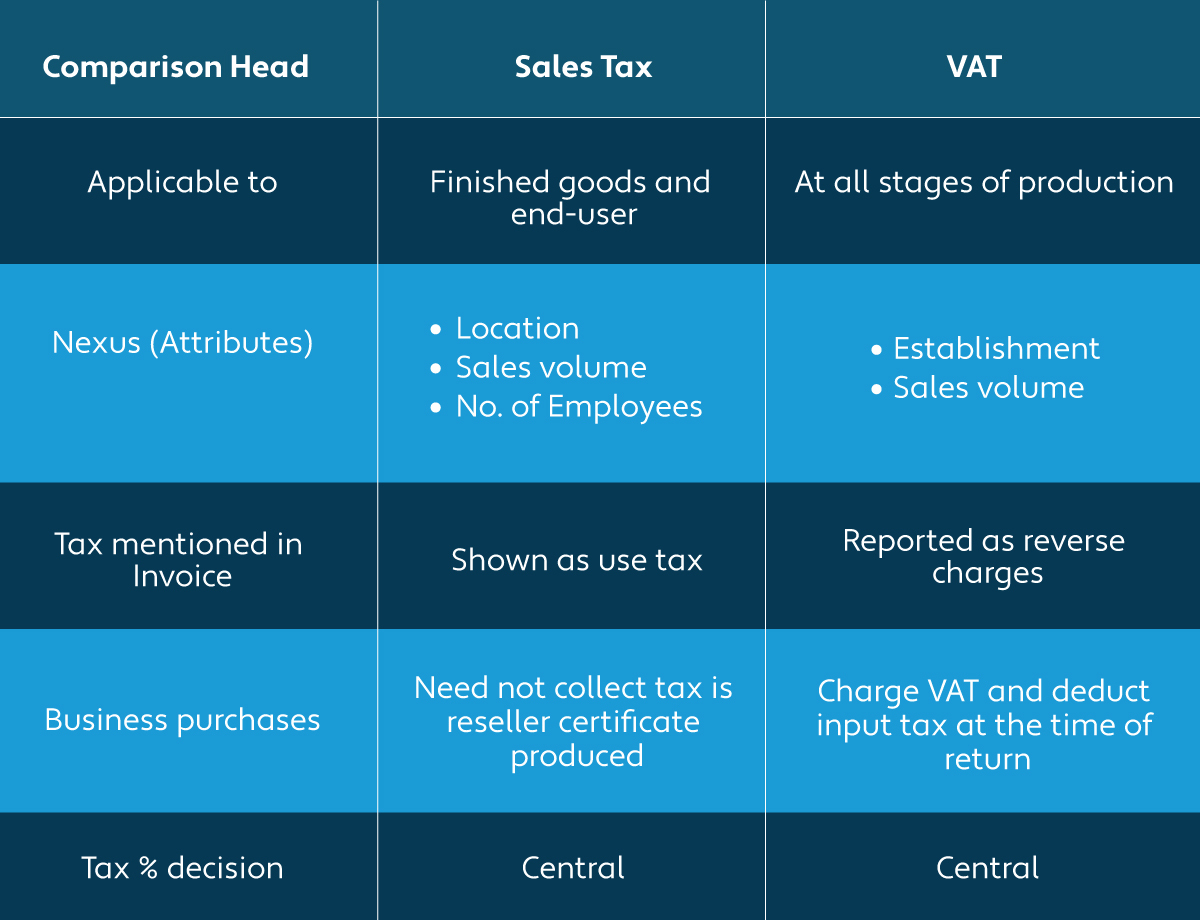

Comparison between Sales tax and VAT – A Ready Reckoner

As a part of the benefit to the business, the government has introduced tax reduction on the profit turnover to businesses who are involved in manufacturing, wholesale, trading or have turned towards digitization.

In fact, only 6% tax is levied on these businesses. This is an incentive for transforming the economy digitally and encourages start-ups to pay taxes.

GST and VAT get exempted in small establishments registered in Special Export Zones of various locations. This GST exemption supports new start-ups business to get established with job opportunities open for more individuals and, at the same time, enables businesses to have input tax levied on purchases made.

How does the AvaTax solution help resolve the above problems?

Tax across the globe is more complex considering the varying practices followed in different countries. Hence there is a need for non-resident sellers to keep track of the exact location of their global customers. The tax also varies in terms of the extent of sales in USD to the number of transactions, depending on the state and product. For a business based outside the USA and EU, it is challenging to understand the tax regimes and accordingly calculate the tax, which ultimately determines the revenue and profit of the business.

It is here that AvaTax comes to the rescue as these complexities are reduced to a mere click of a few buttons. By simply updating the product, volume, origin, and destination address, your tax obligations are ready. What otherwise takes days of painstaking research, calculations, and discussions with tax specialists is completed in a matter of seconds with the absolute assurance of compliance with all tax regulations.

Benefits of using AvaTax

- Backed by tax experts across the globe – Keeping abreast with constantly changing tax laws is challenging and a passion of a very few. Avalara is proud to have a completely dedicated and passionate team of qualified tax experts with a combined experience of over a hundred years in handling US tax requirements across every state.

- Accuracy in tax calculations – With its state of the art software, our tax experts can constantly feed in changes to local regulations as and when they occur. This helps ease calculating tax obligations and helps the user assess the extent of volume output or pricing required to ensure their businesses remain competitive.

- Adherence to regulations at all times – AvaTax promises that you will always be compliant with local regulations. This provides additional time to focus on the business and new and more suitable markets to explore the expansion of the business.

- Avoidance of undue Tax – Users of AvaTax vouch that tax calculations are accurate and there is no undue outflow of funds due to incorrect calculations or understanding of the tax.

- Scalable model – Lack of understanding of Tax regulations is often a deterrent to the expansion of businesses. With AvaTax, there are no limits to your expansion plans, simulating your business growth plans in the exact location or elsewhere has never been easier.