Avalara India GST Returns

Ditch the hassle of filing GST returns manually & automate your GST returns on cloud in easy, quick, and efficient way, every single time

Stop juggling, start focusing

Preparing and filing manual Goods and Services Tax returns is nobody’s idea of a good time. Leave it to Avalara, save time, and refocus on growing your business.

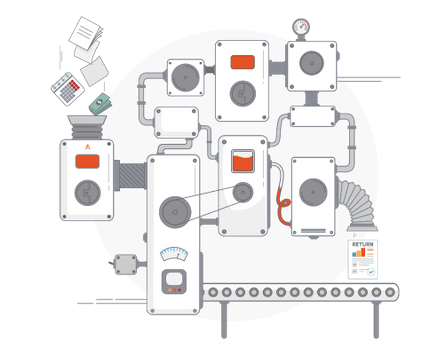

Integrate and automate

Avalara GST Returns can directly access your invoice data through API integration, making your returns filing faster, more accurate, with way lesser hassle than manual filing.

Easier GST compliance

Filing multi-state GST returns for multiple businesses with many users or clients can be complicated. Avalara consolidates all your business units, GSTINs, users, or clients into a single user account for easier compliance.

Reduce audit risk

Keep track of your GST compliance responsibilities, even with changing deadlines and regulations. Avalara helps reduce your risk of inaccuracies and late fees.

Features and benefits

Manage all your GST return forms in one place – from old GST returns (GSTR 1 to GSTR 9) to new GST returns (RET-1, RET-2, RET-3).

Cloud platform keeps your historical filing records along with invoice details for easy future reference.

Check your dashboard to see GST return filing status and stage, to stay up to date and compliant as per GSTN deadlines.

Validate data, flag errors, and handle mismatches of your purchase register with your suppliers’ sales invoices for reconciliation.

Classify supplies, match invoices, and claim provisional Input Tax Credit (ITC) accurately before filing.

No need to remember login passwords anymore. Get digital signature integration to sign off GST returns.

Stay up to date on E-way Bill and GST news

Get regular updates, whitepapers and case studies on our resource center.