Maine provides blanket sales tax exemption for nonprofits

This post has been updated to reflect new information; it was originally published on March 12, 2024.

Governor Janet Mills of Maine wanted to get rid of the red tape that separates many Down East nonprofits from sales tax exemptions. She succeeded: As of January 1, 2025, thousands of nonprofits in Maine will be eligible for a blanket exemption.

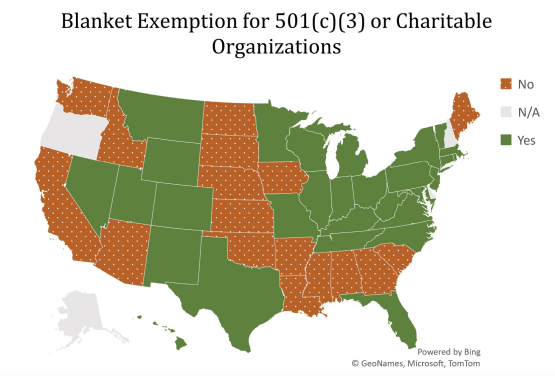

Maine is the only state in New England — and one of just 17 states nationwide — that doesn’t already provide a blanket sales tax exemption for nonprofits, according to a report by Maine Revenue Services (MRS) that was presented to the Maine Legislature in January 2024.

The Maine Association of Nonprofits finds the state’s policy to be “unusual, unfair, confusing, and inefficient,” and they may have a point. In its report to the Legislature, MRS wrote, “The patchwork of exemptions creates substantial ‘gray area’ in some parts of the tax code, posing challenges for taxpayers and for MRS. … This creates uncertainty for organizations, who may not know if they are covered by the exemption and if they should therefore apply, and MRS, who must administer the law and determine which organizations do qualify in line with the intent of the Legislature.”

Which nonprofits are currently exempt from Maine sales tax?

Maine currently provides specific exemptions for organizations and institutions that fall into one of the following categories:

- Child related

- Educational

- Governmental

- Medical and healthcare

- Religious

- Other (e.g., organizations supporting the aging, animals, or veterans)

Operating in one of the above areas doesn’t guarantee exempt status for an organization. Nonprofit entities seeking an exemption are advised to “review the statutory requirements that have to be met.” Given the different exemptions currently on the books, nearly identical organizations could have different eligibility.

If a nonprofit believes it qualifies for a sales tax exemption, it should complete and submit the appropriate application form to MRS. There are close to 65 different application forms as of this writing — a confusing “patchwork of exemptions,” indeed.

What is a blanket exemption?

Generally speaking, a blanket exemption is tied to 501(c) designation. Organizations that are tax exempt under section 501(c)(3) of the Internal Revenue Code automatically qualify for sales-tax-exempt status in the state and can purchase certain goods and services tax free.

This is much more straightforward than establishing one-off exemptions over and over again.

Which nonprofits qualify for the new blanket exemption?

The supplemental budget introduced by Governor Mills provides a blanket sales tax exemption to any nonprofit that’s exempt from federal income tax under Section 501(c)(3). Such entities no longer need to pay the state sales tax on items purchased as part of their mission.

About 5,278 organizations in the state will be eligible for the exemption, according to MRS. “The additional qualifying nonprofit organizations include organizations promoting the arts, culture and humanities; education; human services; philanthropy, voluntarism and grantmaking; environmental quality, protection and beautification; and more.”

Section 501(c)(3) organizations already account for roughly 80% of the existing nonprofit-related sales tax exemptions in Maine. A blanket exemption would not affect these businesses.

How much will the blanket exemption cost the state (and save nonprofits)?

The blanket exemption is expected to cost the state approximately $10 million annually once fully implemented, according to the MRS report. “This includes and assumes a blanket exemption for both sales and use tax and service provider tax.*”

But that $10 million doesn’t tell the whole story. Having a blanket exemption would allow the state to devote less time and resources to sales tax exemptions.

“Efforts to expand or create new exemptions come with opportunity costs,” explains the MRS report. “The Legislature spends considerable time deliberating on proposals to change exemption provisions, often in relation to new and deserving nonprofit organizations. A blanket exemption would dramatically reduce many of these requests, giving lawmakers more time to consider other policy issues.”

Elsewhere the report notes, “The multitude of narrow exemptions enacted over the last 70 years, along with a countless number of exemptions that have been proposed and failed during that same period, has required a considerable time investment by the Legislature and the Executive branch.”

MRS could also benefit from a blanket exemption. Currently, MRS must maintain and update dozens of different applications for nonprofits and help confused nonprofits determine their eligibility. The state tax authority typically receives 100-200 applications for sales tax exemptions from nonprofits each year, a majority of which are approved.

As for how much a blanket exemption could save individual nonprofits, it really depends on the organization. The nonprofit Ruth’s Reusable Resources would be able to provide an additional 50–70 backpacks each year with the $550–$780 in sales tax it could save, according to an article in The Maine Monitor. The youth mentoring nonprofit Trekkers usually spends about $6,000 on sales tax, equivalent to about two-and-a-half months of its student meal budget.

Of course, many nonprofits would also be able to devote fewer resources to establishing exempt status with Maine, which would likely save them time and money. To apply today, organizations generally need to research requirements for the desired exemption and provide articles of incorporation, bylaws, and other documentation demonstrating the exempt purposes.

“The process for applying for exemption would be streamlined,” wrote MRS, “as the only documentation needed from the applicant would be a copy of their IRS determination letter. The requests for additional documentation, evidence of exempt purpose, copies of bylaws, etc. would all be eliminated, making the exemption process simpler for both the applicants and MRS.”

Down-easters should benefit in other ways too. Maine’s nonprofits currently contribute about $14 billion to the economy each year, according to the Maine Association of Nonprofits, and employ more than 100,000 people.

Which states currently provide a blanket exemption for nonprofits?

The blanket exemption would be “consistent with the treatment of nonprofits in most other sales tax states,” Governor Mills said in a statement. The map below, which is from the MRS report, proves her point.

“There are two basic approaches to determining eligibility,” observes MRS, though specific state policies can vary considerably. “Some states issue sales tax exemption certificates to any applicant who submits a valid IRS section 501(c) determination letter — generally under ‘(c)(3).’ Other states independently determine eligibility based on their own state definition of ‘charitable’ purposes. States independently defining ‘charitable’ purposes mostly still recommend (and many require) that applicants submit IRS section 501(c) documentation, if applicable.”

For instance, Texas exempts all entities that hold a 501(c)(3),(4),(8),(10), or (19) of the Internal Revenue Code. Texas Tax Code Section 151.310 reads, in part: “A taxable item sold, leased, or rented to, or stored, used, or consumed by, any of the following organizations is exempted from the taxes imposed by this chapter:

- an organization created for religious, educational, or charitable purposes if no part of the net earnings of the organization benefits a private shareholder or individual and the items purchased, leased, or rented are related to the purpose of the organization;

- an organization qualifying for an exemption from federal income taxes under Section 501(c)(3), (4), (8), (10), or (19), Internal Revenue Code, if the item sold, leased, rented, stored, used, or consumed relates to the purpose of the exempted organization and the item is not used for the personal benefit of a private stockholder or individual”

And so on. The Texas statute goes on to list nonprofit organizations providing athletic competition for persons under 19 years of age, entities organized for the purpose of answering fire alarms, and chamber of commerce or tourist promotional agencies. It’s relatively clear-cut.

California, which doesn’t provide a blanket exemption, takes a different approach. There’s a qualification component, which introduces subjectivity into the process of determining what does and doesn’t qualify for an exemption. Cal. Code Regs. tit. 18, sec. 1570 defines “charitable organization” as any organization meeting all of the enumerated conditions, which include being “engaged in the relief of poverty and distress.”

“There’s no black-and-white way to determine whether an organization should qualify for a sales tax exemption,” says Scott Peterson, VP of Government Relations at Avalara. “It can be painfully subjective.”

There’s no general statewide sales tax in Alaska, Delaware, New Hampshire, and Oregon, and therefore no blanket exemption. Yet Montana, which also has no general statewide sales tax, reportedly provides a blanket exemption for its county-level sales tax.

When does the blanket exemption take effect?

Under the governor’s supplemental budget, which was signed into law on April 22, 2024, a blanket exemption for section 501(c)(3) nonprofit organizations takes effect January 1, 2025. As of that date, tangible personal property or taxable services sold to a section 501(c)(3) nonprofit is exempt provided they’re to be used primarily for the purposes for which the nonprofit organization was organized.

This follows the MRS recommendations.

“A blanket exemption would put us largely in line with neighboring states in the Northeast and tying eligibility directly to an organization’s section 501(c)(3) status will dramatically simplify the process for taxpayers while ensuring the benefit goes to deserving charitable organizations,” writes the MRS in its report to the Legislature. “Similarly situated organizations should receive similar tax benefits, and a blanket exemption for section 501(c)(3) organizations would be a significant step towards that goal of creating a fairer, simpler sales tax.”

Two sides to the blanket exemption coin

The blanket exemption should benefit the affected nonprofits as well as the Legislature and MRS. The nonprofits will spend less time researching and applying for available exemptions; Legislators and MRS will spend less time fielding requests for sales tax exemptions.

However, the change could create a burden for businesses that sell taxable goods or services to nonprofits in Maine. These sellers will need to collect, store, and manage hundreds or even thousands more exemption certificates. If they fail to properly document an exempt transaction, they could be on the hook for the uncollected tax. As Peterson notes, “There’s a lot of risk associated with making exempt sales.”

Automating exemption certificate collection and management can eliminate that risk. Learn more about simplifying exemption certificate management.

*The Maine service provider tax applies to certain services sold in the state, including but not limited to cable and satellite television services, fabrication services, and certain rental services. It’s imposed on the service provider, not the consumer.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.