Is your tax solution keeping up with the challenge of changing sales tax laws?

How are new sales tax laws affecting your tax compliance solution?

The sales tax landscape has changed dramatically since June 2018, when the Supreme Court of the United States ruled businesses don’t need to be physically present in a state to collect sales tax. States can now base a sales tax collection obligation solely on economic activity, or economic nexus, and more and more are doing so. To succeed in this new reality, businesses need a sales tax compliance solution that can handle explosive growth and change.

For our business, that translates to more obligations, more tax calculations — and a lot more returns.

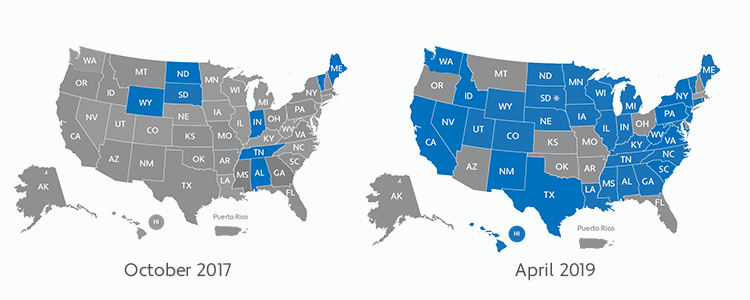

To illustrate the ever-changing landscape, look at how quickly remote seller sales tax laws have spread across the U.S. Few states had an economic nexus law a year and a half ago, and they lacked the authority to enforce compliance.

Today, more than 37 states have adopted economic nexus, and almost every other state with a general sales tax is considering it. Indeed, new economic nexus laws are surfacing with alarming speed. It’s even been discussed by local tax authorities in Alaska, which has no statewide sales tax.

Complying with ever-growing sales tax collection obligations requires a robust sales tax compliance solution that has the resources to adapt to your changing needs.

But what does that really mean for a business that must adapt to an ever-changing tax environment? In short, it means having tax technology that can be on right now, not “be right back.”

We filed more than 1 million returns in 2018. These numbers represent a commitment and proven track record of delivery for our customers when they need it. Avalara has the capacity to grow with your needs — we’ve proven it year after year.

Not every sales tax software company can say the same.

What can a comprehensive tax compliance solution bring to your business?

As other technologies come into the market, it’s important to factor in the following:

- Breadth of integrations. In an omnichannel world, few companies rely on a single platform to sell their wares. When your business grows or changes, you want your tax compliance solution to work with whatever technologies you adopt — not just the ones you have today. Avalara currently integrates with more than 700 business applications, and we’re continuing to grow that number.

- Depth of tax content. It takes years and a host of tax experts to develop and maintain the tax content needed to keep you in compliance across the U.S. and around the world. Avalara has more than 100 employees focused on tax research alone, to help keep our content accurate and up to date.

- Global capability. Cross-border ecommerce is booming. To sell outside of the U.S., you need a tax compliance solution that handles customs duty and import taxes, as well as international tax requirements like VAT and GST.

- Free tax compliance services in 24 states. Avalara is one of six providers certified by the Streamlined Sales and Use Tax Governing Board (SST). As a certified service provider (CSP), Avalara can offer free registration, calculation, and returns services to its qualified customers doing business in the 24 SST states, saving them substantial costs every year.

Avalara offers a wide range of products to meet the varying needs of businesses of all sizes, from a licensing and registration service to get you started in a state, to a suite of products for small ecommerce businesses, to an end-to-end sales tax solution. If you expand globally, we’ll be by your side.

You want a solution that can grow with you right now — because change is happening right now.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.